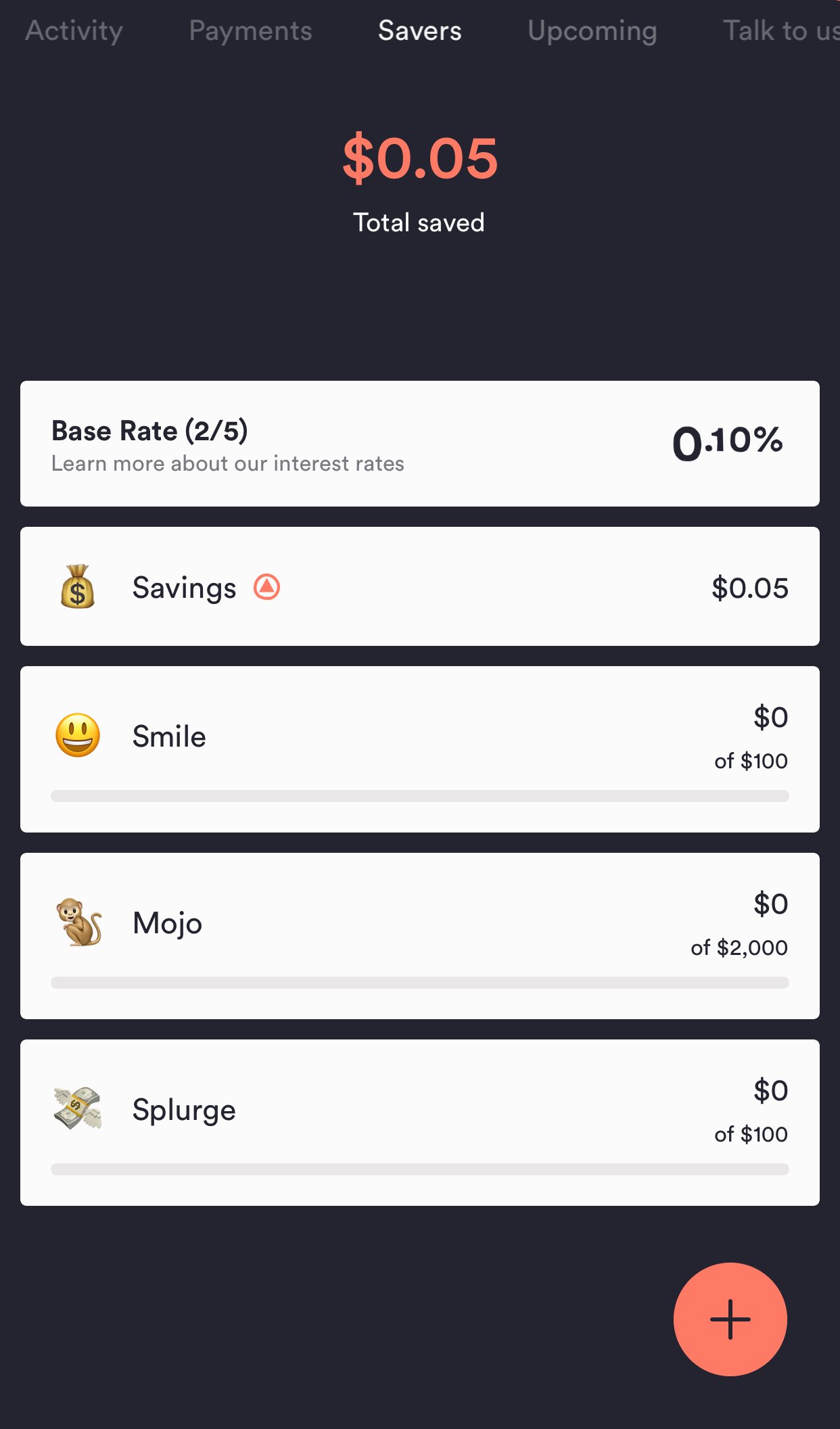

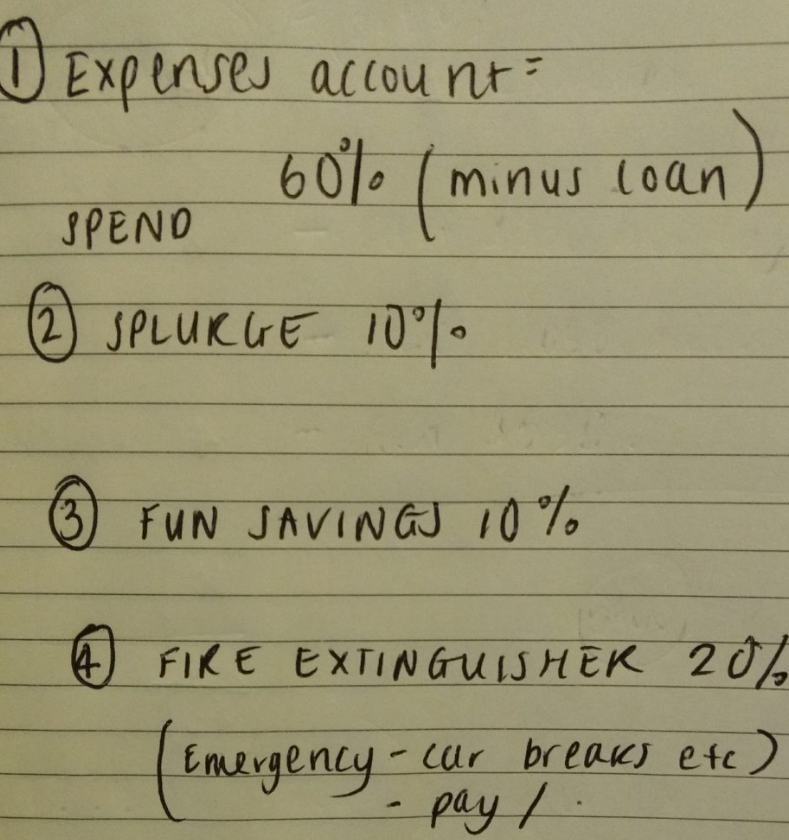

We’re careful to design a structure that’s manageable, comfortable and transparent for each individual client and their style. That way, we can create the most appropriate method for them to track their money. Our expertise is in really getting to know our clients. When people come to us for financial advice, we’ve found a lot of them just don’t know where their money is going on a weekly or monthly basis. We also have creative clients who are just not into tracking their money and the sight of a spreadsheet is their worst nightmare. We’ve advised engineers who arrive for each meeting with every dollar they’ve spent and saved tracked in a spreadsheet. While the Barefoot Investor’s approach is clever, it won’t work for everyone because it’s not tailored to an individual’s style. You’ll be more in control because this system makes sure your daily expenses, emergency money and savings are all covered.Īs financial planners, we’ve seen how differently our clients like to manage their money. It’s quick and easy to do - you’ll be dividing your salary into three different accounts. The Barefoot Investor offers a simple solution to keeping track of your money. The Barefoot Investor’s advice: Budgeting However, if you’re not in this position, you need to consider the ramifications of putting extra money into your super - like for instance delaying getting you on the property ladder.Ĥ. If you’ve got other assets outside of your super and you’re in a wealth accumulation phase, then it might work well for you. While it’s a really efficient way to save for your retirement, it could be detrimental to your overall position - depending on your age or your financial situation. Putting money into your super is another thing that shouldn’t be looked at in isolation.

If you’ve tied up your money in super up to this point, you’re not going to be able to do the things that you want or need to do. For example, if you’re in your mid-twenties and with a partner, you might be considering marriage and buying your first home together. When you’re considering your super strategy, you’ve got to be realistic about what things you might be about to go through in your life and what’s really important to you. Our advice: Don’t put all your eggs in one basket You may find it hard to get enough money into your super before you retire because the maximum you can put in is $25,000 per year.

#Barefoot investor daily expenses full

Your strategy should not be just relying on your super funding your full retirement. You need to put an overall strategy in place to achieve them. So before you direct as much as of your income as possible into your mortgage, consider your longer-term lifestyle goals. If you have no other way of generating an income in retirement, you may end up on an aged pension with a home. If you’re planning to retire and live in this home, it’s not going to pay you any income. Putting all your income into repaying your home loan isn’t going to replace your income when you retire. But if this is all you do, your retirement income will suffer. Repaying your home loan as fast as you can is sensible. Our advice: The other things you must consider He outlines the two ways you can do this: If you have a home loan, The Barefoot Investor recommends making a plan to pay it off faster. The Barefoot Investor’s advice on: paying down your home loan Paying down a home loan: Is faster better? taking the pressure off by getting a bigger house for your growing family sooner rather than later and locking in a home closer to the school of your choice.Ģ. By investing in property earlier, you might not only save money in the long-term, but you’ll also struggle less with emotional stress - e.g. Mortgage insurance might be costly, but it can be a much quicker way to get you on the property ladder. You might have saved yourself the $30,000 in LMI however you’re $250,000 worse off when it comes to the price you’ve had to pay for the property. By the time you’re ready to buy, that million dollar property is now a $1,250,0000 property. In this time, the property market goes up.

In reality, saving this extra amount turns out to take you longer - another three years. So you decide to wait and save an extra 10 per cent deposit which you think will take you two years. You’ve saved enough for a 10% deposit and are in a position to buy that million property today, but you want to avoid LMI.

0 kommentar(er)

0 kommentar(er)